The market dichotomy

- June 28, 2023

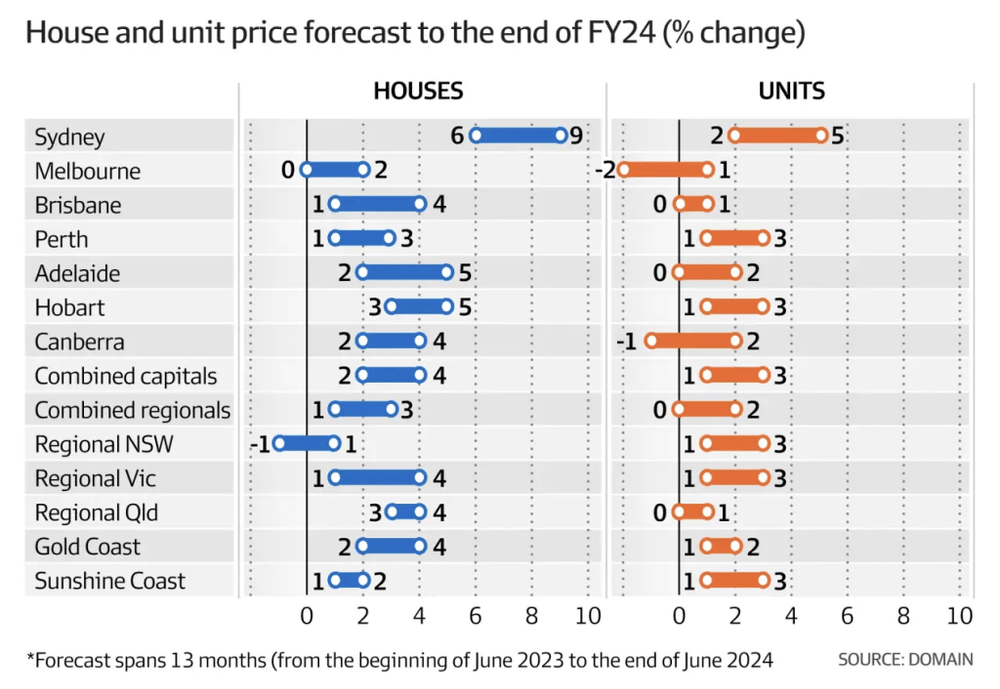

If you’re trying to make sense of the current property market, you’re not alone. As we continue to navigate our way through a period of high inflation and a rapidly rising cash rate environment, Sydney property has boldly been posting modest price growth. According to CoreLogic, Sydney prices have climbed by around 5% since the end of summer, and the growth trajectory is expected to continue into 2024. We’ve been incredibly critical of the highly unreliable bank and property market commentators’ house price forecasts; however, the current narrative being pushed around the media is that the cash rate will hit 4.6% in August, yet the chronically low supply of listings, tight unemployment, and high migration will continue to fuel house price growth through to the end of 2024. In fact, every major bank is forecasting property prices to rise in 2024, with Domain forecasting house prices will rise by 9% to close off 2024.  For the common person monitoring the market, the assumption is that with rates rising quickly, borrowing power for most of the market being curbed by around 30%, and monthly repayments up by about 140%, this should mean there is downward pressure on prices, right? Sadly, for those awaiting the ‘market crash,’ there is no evidence of such an outcome unfolding for now. Here lies the challenging conundrum with the property market. Consumer confidence is weak. In fact, when ANZ conducted their survey question, ‘How is your financial position compared to a year ago?’ The outcome posted the worst result ever recorded and had declined 10.6 points in the past four-week period. CBA and Westpac have also slashed their mortgage stress test for many borrowers looking to refinance their loan from 3% to 1%, suggesting many customers are right on the brink of being able to service their monthly repayments. CoreLogic data has also revealed that many investors are dumping their properties onto the market, with 43% of new listings hitting the market in May being rental properties. Are these investors feeling the pinch of higher rates, or are people selling to take a more conservative cash position?

For the common person monitoring the market, the assumption is that with rates rising quickly, borrowing power for most of the market being curbed by around 30%, and monthly repayments up by about 140%, this should mean there is downward pressure on prices, right? Sadly, for those awaiting the ‘market crash,’ there is no evidence of such an outcome unfolding for now. Here lies the challenging conundrum with the property market. Consumer confidence is weak. In fact, when ANZ conducted their survey question, ‘How is your financial position compared to a year ago?’ The outcome posted the worst result ever recorded and had declined 10.6 points in the past four-week period. CBA and Westpac have also slashed their mortgage stress test for many borrowers looking to refinance their loan from 3% to 1%, suggesting many customers are right on the brink of being able to service their monthly repayments. CoreLogic data has also revealed that many investors are dumping their properties onto the market, with 43% of new listings hitting the market in May being rental properties. Are these investors feeling the pinch of higher rates, or are people selling to take a more conservative cash position?

There is much to unpack with the current market dynamic, as almost all economic data points suggest the economy is softening. It’s fair to say that many people underestimated what would unfold with the property market when new listing levels tightened and are now tracking at close to a 15-year low. Within our core regions, we’re seeing listing levels down more like 40%-50%, and from an active buyer’s perspective, we’re consistently hearing ‘there is nothing on the market.’ For now, buyer demand is operating well above the supply of new listings becoming available. Take, for example, 84 Rose Street, Annandale, which had 82 individual buyer inspections on Saturday in just a 30-minute opening window. Granted, this was a pretty home, but that’s a big turnout and reflects there is healthy demand moving through the market. It appears the winter market will continue to see a tight supply of listings that should continue to maintain the status quo in conditions, but it’s hard not to ignore the looming economic clouds that continue to gather.

From our perspective, this is a period that should be assessed fortnightly, as consumer sentiment is fickle and can quickly shift. At the time of writing, there is some positive news about property prices rising into 2024, and the market will absorb this, but we could be reading an entirely contradictory piece of information next week. We’re watching the unemployment rate closely, and if there is an increase in listing levels, one will have an impact on the cash rate, while the other will have an impact on the level of buyer demand we’re experiencing. Stay tuned to our weekly reports and ‘The Word’ with Matt Hayson, as there has never been a more important time to keep your finger on the pulse of the property market.