Are we seeing the market stabilise?

- September 29, 2022

Judging by the level of online enquiry and the conversion through to foot traffic at our open homes, market sentiment is elevating despite overall conditions remaining choppy. Rapidly rising rates abruptly closed the era of near-free borrowing and now that the initial shock and awe has been digested we’re all adjusting to the new environment. Consequently, property conditions have marginally improved and a new rhythm of engagement has emerged in the current climate. While this will continue to transition, we’re currently working with a better prepared buyer pool and more transactions have unfolded that provide immediate pricing evidence, with sellers open to negotiating.

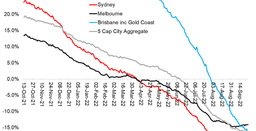

Even CoreLogic data indicates that the rate of price decline is slowing, which is a positive sign that market conditions are acclimatising. Sydney’s auction clearance rate is also improving – according to SQM Research it has lifted from the terminal rate of 40% and is currently sitting at 45%. While these adjustments may be minor, they’re a step in the right direction. The clear positive that we’re experiencing right now is buyer interest and activity, which is the critical component in any market. If we have buyer interest, then sales can occur even if a seller needs to adjust their expectations.

It would be foolish to suggest that the market is now in the clear but it’s encouraging to see that in a matter of months, buyers and sellers have adjusted just as quickly as rates have been rising. For the moment, we’re finding some balance in the market. We now await the RBA’s October board meeting but we’re optimistic about how the Sydney market is absorbing this new cycle.